Try Fund Library Premium

For Free with a 30 day trial!

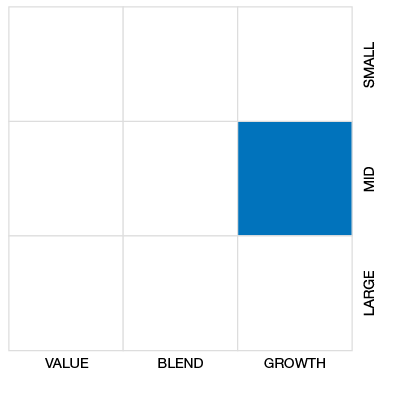

Cdn Small/Mid Cap Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

2017, 2016, 2015, 2014

Click for more information on Fundata’s FundGrade

|

NAVPS (08-20-2025) |

$30.18 |

|---|---|

| Change |

$0.12

(0.41%)

|

As at July 31, 2025

As at July 31, 2025

Inception Return (February 14, 2011): 9.32%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 1.19% | 13.29% | 4.57% | 7.21% | 15.18% | 13.09% | 6.70% | -0.57% | 9.18% | 5.85% | 4.10% | 4.34% | 4.75% | 4.39% |

| Benchmark | 1.50% | 15.54% | 13.69% | 14.43% | 18.09% | 16.08% | 11.83% | 7.46% | 13.78% | 10.14% | 7.96% | 7.49% | 6.43% | 8.06% |

| Category Average | 1.07% | 12.99% | 7.74% | 8.34% | 11.85% | 12.90% | 9.63% | 5.46% | 11.67% | 9.21% | 7.21% | 6.97% | 6.57% | 6.42% |

| Category Rank | 96 / 201 | 98 / 201 | 176 / 200 | 140 / 200 | 60 / 200 | 119 / 196 | 177 / 194 | 187 / 193 | 146 / 180 | 162 / 177 | 154 / 170 | 148 / 166 | 135 / 158 | 120 / 136 |

| Quartile Ranking | 2 | 2 | 4 | 3 | 2 | 3 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 |

| Return % | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 0.07% | 3.25% | 1.68% | 6.44% | -3.93% | 2.53% | -3.82% | -3.86% | -0.18% | 6.58% | 5.05% | 1.19% |

| Benchmark | -1.26% | 3.80% | 1.39% | 2.69% | -3.30% | 0.65% | -2.27% | 2.56% | -1.83% | 7.20% | 6.19% | 1.50% |

16.73% (April 2020)

-24.32% (March 2020)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -5.76% | 21.94% | -0.40% | -12.92% | 14.78% | 16.34% | 19.17% | -22.53% | -1.66% | 22.40% |

| Benchmark | -13.31% | 38.48% | 2.75% | -18.17% | 15.84% | 12.87% | 20.27% | -9.29% | 4.79% | 18.83% |

| Category Average | -6.13% | 18.01% | 3.43% | -15.15% | 16.59% | 11.91% | 22.35% | -11.32% | 6.49% | 16.84% |

| Quartile Ranking | 3 | 2 | 4 | 2 | 4 | 2 | 4 | 4 | 4 | 1 |

| Category Rank | 87/ 131 | 54/ 153 | 128/ 158 | 62/ 167 | 149/ 174 | 80/ 179 | 145/ 186 | 192/ 194 | 180/ 196 | 47/ 197 |

22.40% (2024)

-22.53% (2022)

| Name | Percent |

|---|---|

| Canadian Equity | 78.03 |

| Income Trust Units | 8.82 |

| International Equity | 7.22 |

| US Equity | 5.81 |

| Cash and Equivalents | 0.13 |

| Name | Percent |

|---|---|

| Real Estate | 20.68 |

| Financial Services | 16.00 |

| Industrial Services | 14.01 |

| Technology | 12.46 |

| Basic Materials | 12.20 |

| Other | 24.65 |

| Name | Percent |

|---|---|

| North America | 86.78 |

| Latin America | 8.20 |

| Europe | 4.99 |

| Africa and Middle East | 0.04 |

| Name | Percent |

|---|---|

| Brookfield Business Partners LP - Units | 5.49 |

| Trisura Group Ltd | 4.19 |

| Cargojet Inc | 3.94 |

| Parkit Enterprise Inc | 3.80 |

| Celestica Inc | 3.44 |

| GFL Environmental Inc | 3.28 |

| Kneat.com Inc | 3.23 |

| OR Royalties Inc | 3.06 |

| TFI International Inc | 2.99 |

| Element Fleet Management Corp | 2.77 |

CI Canadian Small/Mid Cap Equity Fund (Series A units)

Median

Other - Cdn Small/Mid Cap Equity

| Standard Deviation | 15.24% | 16.51% | 16.73% |

|---|---|---|---|

| Beta | 0.84% | 0.72% | 0.69% |

| Alpha | -0.03% | 0.00% | -0.01% |

| Rsquared | 0.57% | 0.54% | 0.67% |

| Sharpe | 0.24% | 0.46% | 0.24% |

| Sortino | 0.46% | 0.66% | 0.22% |

| Treynor | 0.04% | 0.11% | 0.06% |

| Tax Efficiency | 99.03% | 99.52% | 93.43% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 13.12% | 15.24% | 16.51% | 16.73% |

| Beta | 0.88% | 0.84% | 0.72% | 0.69% |

| Alpha | 0.00% | -0.03% | 0.00% | -0.01% |

| Rsquared | 0.58% | 0.57% | 0.54% | 0.67% |

| Sharpe | 0.90% | 0.24% | 0.46% | 0.24% |

| Sortino | 1.68% | 0.46% | 0.66% | 0.22% |

| Treynor | 0.13% | 0.04% | 0.11% | 0.06% |

| Tax Efficiency | 98.70% | 99.03% | 99.52% | 93.43% |

| Start Date | February 14, 2011 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $80 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| CIG11109 | ||

| CIG11159 | ||

| CIG11359 | ||

| CIG11459 |

The fund’s objective is to achieve long-term capital growth by investing a substantial portion of its assets, directly or indirectly, in equity securities of Canadian companies. Indirect investments may include convertible securities, derivatives, equity-related securities and securities of other mutual funds.

When buying and selling securities for the fund, the portfolio advisor examines each company’s potential for success in light of its current financial condition, its industry positioning, and economic and market conditions. The portfolio advisor considers factors like growth potential, earning estimates, quality of management and current market value of the securities.

| Portfolio Manager |

CI Global Asset Management

|

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

CI Global Asset Management |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

CI Global Asset Management |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 50 |

| PAC Subsequent | 50 |

| SWP Allowed | Yes |

| SWP Min Balance | 500 |

| SWP Min Withdrawal | 100 |

| MER | 2.44% |

|---|---|

| Management Fee | 2.00% |

| Load | Choice of Front or No Load |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | 0.50% |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!