Try Fund Library Premium

For Free with a 30 day trial!

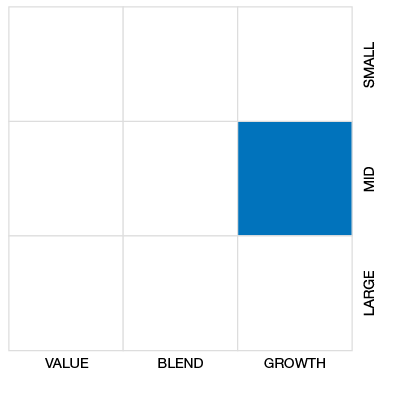

Global Small/Mid Cap Eq

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (01-26-2026) |

$21.16 |

|---|---|

| Change |

-$0.06

(-0.27%)

|

As at December 31, 2025

As at December 31, 2025

Inception Return (June 28, 2013): 8.18%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 2.07% | -1.19% | -0.41% | -3.31% | -3.31% | 22.13% | 16.69% | 2.21% | 1.39% | 4.12% | 6.01% | 3.95% | 4.28% | 5.60% |

| Benchmark | -0.85% | 0.75% | 9.03% | 11.95% | 11.95% | 15.27% | 15.04% | 7.24% | 8.84% | 9.21% | 10.70% | 8.27% | 9.04% | 8.88% |

| Category Average | -0.41% | 0.38% | 6.33% | 12.29% | 12.29% | 12.17% | 12.38% | 4.62% | 6.13% | 7.48% | 8.36% | 5.81% | 6.55% | 6.24% |

| Category Rank | 5 / 287 | 195 / 278 | 253 / 278 | 257 / 270 | 257 / 270 | 15 / 257 | 31 / 239 | 127 / 228 | 185 / 206 | 152 / 171 | 141 / 165 | 116 / 139 | 118 / 129 | 102 / 123 |

| Quartile Ranking | 1 | 3 | 4 | 4 | 4 | 1 | 1 | 3 | 4 | 4 | 4 | 4 | 4 | 4 |

| Return % | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 1.13% | -4.51% | -7.64% | -1.24% | 4.56% | 5.41% | -1.03% | 1.78% | 0.06% | -0.80% | -2.41% | 2.07% |

| Benchmark | 4.42% | -3.55% | -4.14% | -3.02% | 5.68% | 3.76% | 2.68% | 2.65% | 2.67% | 0.79% | 0.81% | -0.85% |

14.19% (November 2020)

-28.45% (March 2020)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 18.26% | 6.98% | -9.41% | 18.13% | 18.92% | -1.82% | -31.33% | 6.54% | 54.25% | -3.31% |

| Benchmark | 7.47% | 15.40% | -7.34% | 20.09% | 11.07% | 15.50% | -13.14% | 14.59% | 18.68% | 11.95% |

| Category Average | 3.48% | 12.62% | -10.42% | 13.76% | 14.53% | 12.37% | -15.59% | 12.82% | 12.04% | 12.29% |

| Quartile Ranking | 1 | 4 | 3 | 2 | 3 | 4 | 4 | 4 | 1 | 4 |

| Category Rank | 19/ 123 | 107/ 129 | 81/ 139 | 72/ 165 | 87/ 171 | 206/ 206 | 194/ 228 | 202/ 239 | 4/ 257 | 257/ 270 |

54.25% (2024)

-31.33% (2022)

| Name | Percent |

|---|---|

| Canadian Equity | 62.69 |

| US Equity | 28.89 |

| International Equity | 6.33 |

| Income Trust Units | 2.00 |

| Derivatives | 0.09 |

| Name | Percent |

|---|---|

| Technology | 22.25 |

| Consumer Goods | 14.70 |

| Financial Services | 13.93 |

| Industrial Goods | 9.38 |

| Consumer Services | 9.17 |

| Other | 30.57 |

| Name | Percent |

|---|---|

| North America | 91.58 |

| Europe | 6.33 |

| Latin America | 2.09 |

| Name | Percent |

|---|---|

| Premium Brands Holdings Corp | 5.88 |

| Trisura Group Ltd | 4.46 |

| PAR Technology Corp | 4.24 |

| Telesat Corp Cl A | 3.94 |

| Ero Copper Corp | 3.86 |

| TerraVest Industries Inc | 3.75 |

| Aecon Group Inc | 3.71 |

| Tantalus Systems Holding Inc | 3.60 |

| Kinaxis Inc | 3.56 |

| StandardAero Inc | 3.36 |

Pender Global Small/Mid Cap Equity Fund Class A

Median

Other - Global Small/Mid Cap Eq

| Standard Deviation | 17.72% | 17.22% | 18.80% |

|---|---|---|---|

| Beta | 1.23% | 1.03% | 1.12% |

| Alpha | -0.01% | -0.07% | -0.03% |

| Rsquared | 0.74% | 0.64% | 0.71% |

| Sharpe | 0.74% | 0.01% | 0.29% |

| Sortino | 1.40% | -0.02% | 0.32% |

| Treynor | 0.11% | 0.00% | 0.05% |

| Tax Efficiency | 92.41% | 43.45% | 86.99% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 12.62% | 17.72% | 17.22% | 18.80% |

| Beta | 0.88% | 1.23% | 1.03% | 1.12% |

| Alpha | -0.13% | -0.01% | -0.07% | -0.03% |

| Rsquared | 0.62% | 0.74% | 0.64% | 0.71% |

| Sharpe | -0.41% | 0.74% | 0.01% | 0.29% |

| Sortino | -0.57% | 1.40% | -0.02% | 0.32% |

| Treynor | -0.06% | 0.11% | 0.00% | 0.05% |

| Tax Efficiency | - | 92.41% | 43.45% | 86.99% |

| Start Date | June 28, 2013 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $95 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| PGF200 |

The investment objective of the Fund is to achieve capital growth over the long-term, while being sufficiently diversified to mitigate volatility. The Fund will invest primarily in Canadian and US securities but may also invest in foreign securities. The Fund will focus on businesses that have the potential for growth over the long term and have securities that trade at favourable prices.

The Manager will examine each potential investment for success in light of current economic and market conditions, its industry position, its current financial position, its growth potential, earnings estimates and the quality of its management. The Fund will invest primarily in small and mid-cap companies in North America.

| Portfolio Manager |

PenderFund Capital Management Ltd.

|

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

PenderFund Capital Management Ltd. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

CIBC Mellon Trust Company |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 0 |

| PAC Subsequent | 0 |

| SWP Allowed | No |

| SWP Min Balance | - |

| SWP Min Withdrawal | - |

| MER | 2.51% |

|---|---|

| Management Fee | 1.85% |

| Load | Back Fee Only |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 0.85% |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!