Try Fund Library Premium

For Free with a 30 day trial!

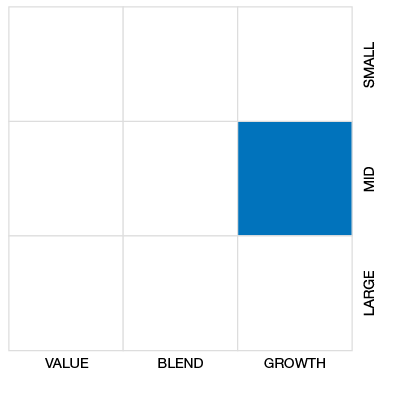

Cdn Foc Small/Mid Cap Eq

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

2016, 2015, 2014, 2013, 2012

Click for more information on Fundata’s FundGrade

|

NAVPS (03-05-2026) |

$31.36 |

|---|---|

| Change |

-$0.14

(-0.44%)

|

As at January 31, 2026

As at January 31, 2026

Inception Return (July 28, 2005): 9.73%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | -0.37% | 0.08% | 1.71% | -0.37% | 1.36% | 10.18% | 8.50% | 5.31% | 6.91% | 6.74% | 7.39% | 5.78% | 5.98% | 7.53% |

| Benchmark | 6.98% | 12.32% | 30.53% | 6.98% | 42.45% | 31.91% | 19.88% | 14.61% | 14.57% | 14.82% | 13.71% | 10.77% | 10.25% | 12.46% |

| Category Average | 1.99% | 3.14% | 6.74% | 1.99% | 9.78% | 14.13% | 10.76% | 6.72% | 6.78% | 10.43% | 10.92% | 8.69% | 9.04% | 10.21% |

| Category Rank | 45 / 48 | 45 / 48 | 45 / 48 | 45 / 48 | 45 / 48 | 43 / 48 | 34 / 48 | 33 / 48 | 28 / 48 | 36 / 48 | 37 / 45 | 28 / 36 | 27 / 35 | 23 / 34 |

| Quartile Ranking | 4 | 4 | 4 | 4 | 4 | 4 | 3 | 3 | 3 | 3 | 4 | 4 | 4 | 3 |

| Return % | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -3.80% | -5.39% | -0.61% | 5.23% | 3.77% | 0.88% | 0.38% | 2.04% | -0.77% | -1.01% | 1.47% | -0.37% |

| Benchmark | -2.72% | 0.21% | -2.24% | 6.67% | 5.34% | 1.91% | 7.00% | 6.73% | 1.77% | 3.68% | 1.26% | 6.98% |

15.06% (April 2020)

-22.36% (March 2020)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 14.56% | 8.43% | -10.41% | 18.28% | 8.01% | 18.71% | -14.05% | 8.67% | 19.60% | 4.60% |

| Benchmark | 27.23% | 7.15% | -14.41% | 17.42% | 12.92% | 18.74% | -10.51% | 8.17% | 18.86% | 35.78% |

| Category Average | 16.27% | 9.79% | -11.20% | 21.83% | 30.06% | 13.94% | -13.64% | 7.90% | 18.68% | 9.65% |

| Quartile Ranking | 3 | 3 | 2 | 3 | 3 | 3 | 3 | 2 | 2 | 4 |

| Category Rank | 24/ 34 | 23/ 35 | 18/ 36 | 27/ 39 | 34/ 48 | 34/ 48 | 31/ 48 | 19/ 48 | 21/ 48 | 44/ 48 |

19.60% (2024)

-14.05% (2022)

| Name | Percent |

|---|---|

| Canadian Equity | 52.95 |

| US Equity | 30.53 |

| Income Trust Units | 10.48 |

| International Equity | 5.95 |

| Cash and Equivalents | 0.10 |

| Name | Percent |

|---|---|

| Real Estate | 24.37 |

| Financial Services | 15.91 |

| Industrial Goods | 12.34 |

| Consumer Services | 12.11 |

| Technology | 11.82 |

| Other | 23.45 |

| Name | Percent |

|---|---|

| North America | 83.88 |

| Latin America | 12.71 |

| Europe | 3.41 |

| Name | Percent |

|---|---|

| Information Services Corp Cl A | 7.53 |

| Brookfield Business Partners LP - Units | 5.81 |

| Brookfield Infrastructure Partners LP - Units | 4.37 |

| KKR & Co Inc | 4.08 |

| Cargojet Inc | 3.92 |

| Trisura Group Ltd | 3.92 |

| AMETEK Inc | 3.35 |

| Atlanta Braves Holdings Inc | 3.17 |

| Live Nation Entertainment Inc | 3.16 |

| Waste Connections Inc | 3.13 |

CI North American Small/Mid Cap Equity Fund Series A

Median

Other - Cdn Foc Small/Mid Cap Eq

| Standard Deviation | 13.16% | 13.95% | 15.06% |

|---|---|---|---|

| Beta | 0.71% | 0.74% | 0.76% |

| Alpha | -0.05% | -0.03% | -0.02% |

| Rsquared | 0.44% | 0.56% | 0.73% |

| Sharpe | 0.40% | 0.35% | 0.44% |

| Sortino | 0.76% | 0.50% | 0.51% |

| Treynor | 0.07% | 0.07% | 0.09% |

| Tax Efficiency | 92.78% | 91.13% | 88.51% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 10.13% | 13.16% | 13.95% | 15.06% |

| Beta | 0.52% | 0.71% | 0.74% | 0.76% |

| Alpha | -0.17% | -0.05% | -0.03% | -0.02% |

| Rsquared | 0.40% | 0.44% | 0.56% | 0.73% |

| Sharpe | -0.07% | 0.40% | 0.35% | 0.44% |

| Sortino | -0.16% | 0.76% | 0.50% | 0.51% |

| Treynor | -0.01% | 0.07% | 0.07% | 0.09% |

| Tax Efficiency | 59.19% | 92.78% | 91.13% | 88.51% |

| Start Date | July 28, 2005 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Monthly |

| Assets ($mil) | $1,007 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| CIG1921 | ||

| CIG3921 | ||

| CIG50221 |

The Fund’s investment objective is to provide consistent monthly income and capital appreciation by investing in equity securities of small and medium capitalization companies and trusts, as well as preferred securities and convertible debentures and, to a lesser extent, in other interest-bearing securities, such as bonds, bills or bankers’ acceptances.

The Manager employs a value-oriented investment approach, using fundamental analysis to identify companies that have high returns on invested capital, generate free cash flow and have modest capital expenditure requirements. In addition, the Fund may hold preferred securities and convertible debentures.

| Portfolio Manager |

CI Global Asset Management

|

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

CI Global Asset Management |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

CI Global Asset Management |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 500 |

| PAC Subsequent | 25 |

| SWP Allowed | Yes |

| SWP Min Balance | 10,000 |

| SWP Min Withdrawal | 100 |

| MER | 2.42% |

|---|---|

| Management Fee | 2.00% |

| Load | Choice of Front or No Load |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | 0.50% |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!