Try Fund Library Premium

For Free with a 30 day trial!

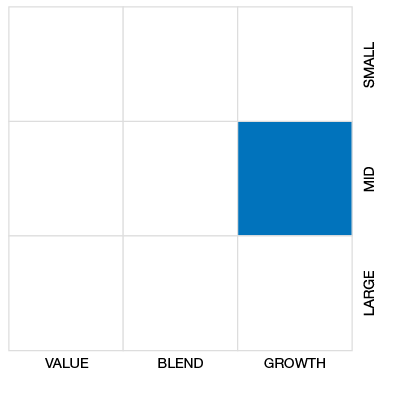

Global Small/Mid Cap Eq

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (01-27-2026) |

$10.17 |

|---|---|

| Change |

-$0.11

(-1.10%)

|

As at December 31, 2025

As at October 31, 2025

Inception Return (September 09, 2020): 3.41%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | -0.83% | -1.76% | 3.73% | -2.45% | -2.45% | 0.49% | 3.27% | -2.77% | 0.84% | - | - | - | - | - |

| Benchmark | -0.85% | 0.75% | 9.03% | 11.95% | 11.95% | 15.27% | 15.04% | 7.24% | 8.84% | 9.21% | 10.70% | 8.27% | 9.04% | 8.88% |

| Category Average | -0.41% | 0.38% | 6.33% | 12.29% | 12.29% | 12.17% | 12.38% | 4.62% | 6.13% | 7.48% | 8.36% | 5.81% | 6.55% | 6.24% |

| Category Rank | 151 / 287 | 206 / 278 | 176 / 278 | 252 / 270 | 252 / 270 | 247 / 257 | 229 / 239 | 216 / 228 | 193 / 206 | - | - | - | - | - |

| Quartile Ranking | 3 | 3 | 3 | 4 | 4 | 4 | 4 | 4 | 4 | - | - | - | - | - |

| Return % | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 2.76% | -3.31% | -5.36% | -7.04% | 4.33% | 3.13% | 1.91% | 4.54% | -0.89% | -3.15% | 2.28% | -0.83% |

| Benchmark | 4.42% | -3.55% | -4.14% | -3.02% | 5.68% | 3.76% | 2.68% | 2.65% | 2.67% | 0.79% | 0.81% | -0.85% |

10.96% (November 2020)

-7.04% (April 2025)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | - | - | - | - | - | 16.69% | -18.87% | 9.07% | 3.51% | -2.45% |

| Benchmark | 7.47% | 15.40% | -7.34% | 20.09% | 11.07% | 15.50% | -13.14% | 14.59% | 18.68% | 11.95% |

| Category Average | 3.48% | 12.62% | -10.42% | 13.76% | 14.53% | 12.37% | -15.59% | 12.82% | 12.04% | 12.29% |

| Quartile Ranking | - | - | - | - | - | 2 | 4 | 4 | 4 | 4 |

| Category Rank | - | - | - | - | - | 56/ 206 | 173/ 228 | 181/ 239 | 209/ 257 | 252/ 270 |

16.69% (2021)

-18.87% (2022)

| Name | Percent |

|---|---|

| US Equity | 59.93 |

| International Equity | 32.59 |

| Cash and Equivalents | 5.71 |

| Canadian Equity | 1.77 |

| Name | Percent |

|---|---|

| Financial Services | 27.65 |

| Industrial Services | 13.94 |

| Industrial Goods | 11.26 |

| Technology | 9.45 |

| Basic Materials | 9.17 |

| Other | 28.53 |

| Name | Percent |

|---|---|

| North America | 67.41 |

| Europe | 15.67 |

| Asia | 8.28 |

| Latin America | 5.88 |

| Africa and Middle East | 2.77 |

| Name | Percent |

|---|---|

| Cash and Cash Equivalents | 5.71 |

| Assured Guaranty Ltd | 2.43 |

| Academy Sports and Outdoors Inc | 2.41 |

| Hackett Group Inc | 2.20 |

| International General Insurnce Hdg Ltd | 2.12 |

| Advance Auto Parts Inc | 2.07 |

| Barrett Business Services Inc | 2.03 |

| MSC Industrial Direct Co Inc Cl A | 2.01 |

| Healthcare Services Group Inc | 2.00 |

| FTAI Aviation Ltd | 1.97 |

Canada Life Global Small-Mid Cap Equity Fund A

Median

Other - Global Small/Mid Cap Eq

| Standard Deviation | 11.73% | 12.59% | - |

|---|---|---|---|

| Beta | 0.81% | 0.84% | - |

| Alpha | -0.08% | -0.06% | - |

| Rsquared | 0.73% | 0.80% | - |

| Sharpe | 0.00% | -0.09% | - |

| Sortino | 0.11% | -0.15% | - |

| Treynor | 0.00% | -0.01% | - |

| Tax Efficiency | 46.58% | - | - |

| Volatility |

|

|

- |

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 13.46% | 11.73% | 12.59% | - |

| Beta | 1.03% | 0.81% | 0.84% | - |

| Alpha | -0.14% | -0.08% | -0.06% | - |

| Rsquared | 0.75% | 0.73% | 0.80% | - |

| Sharpe | -0.32% | 0.00% | -0.09% | - |

| Sortino | -0.44% | 0.11% | -0.15% | - |

| Treynor | -0.04% | 0.00% | -0.01% | - |

| Tax Efficiency | - | 46.58% | - | - |

| Start Date | September 09, 2020 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | - |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $60 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| MAX7811 | ||

| MAX7911 | ||

| MAX8011 |

The Fund seeks to provide long-term capital growth by investing primarily in equity securities of global small to mid-capitalization companies. The Fund will pursue this objective by investing in securities directly and/or by investing in other mutual funds. Any proposed change to the fundamental investment objectives of the Fund must be approved by a majority of votes cast at meeting of the Fund’s investors called for that purpose.

A multi-portfolio manager approach is used by the sub-advisor, with each portfolio manager focusing on different geographic locations. U.S. Mid-Cap The sub-advisor seeks companies with strong management, good growth prospects and attractive financial metrics. Emphasis is also placed on paying reasonable prices for the growth that companies in the portfolio are expected to achieve.

| Portfolio Manager |

Canada Life Investment Management Ltd. |

|---|---|

| Sub-Advisor |

Royce & Associates, LP, Franklin Advisers, Inc.

Franklin Templeton Investments Corp.

Franklin Advisers, Inc.

|

| Fund Manager |

Canada Life Investment Management Ltd. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

Mackenzie Financial Corporation |

| Distributor |

Quadrus Investment Services Limited IPC Investment Corporation IPC Securities Corporation |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 25 |

| PAC Subsequent | 25 |

| SWP Allowed | No |

| SWP Min Balance | - |

| SWP Min Withdrawal | - |

| MER | 2.65% |

|---|---|

| Management Fee | 2.00% |

| Load | Choice of Front or No Load |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!