Try Fund Library Premium

For Free with a 30 day trial!

Greater China Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

2024, 2018, 2017, 2016

Click for more information on Fundata’s FundGrade

|

NAVPS (02-13-2026) |

$37.86 |

|---|---|

| Change |

-$0.22

(-0.57%)

|

As at January 31, 2026

As at December 31, 2025

Inception Return (May 04, 2006): 7.93%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 3.78% | -0.95% | 9.79% | 3.78% | 23.58% | 26.21% | 7.01% | 6.64% | 4.40% | 5.05% | 3.53% | 1.83% | 5.58% | 6.49% |

| Benchmark | 1.29% | 5.38% | 22.66% | 1.29% | 30.54% | 29.58% | 6.43% | 2.50% | 1.40% | 7.13% | 7.61% | 2.33% | 3.41% | 3.27% |

| Category Average | 3.97% | 1.16% | 17.47% | 3.97% | 29.15% | 29.19% | 6.07% | 2.47% | -1.42% | 3.31% | 3.42% | 1.19% | 5.26% | 6.21% |

| Category Rank | 25 / 61 | 28 / 61 | 47 / 60 | 25 / 61 | 27 / 59 | 32 / 58 | 21 / 57 | 12 / 57 | 10 / 57 | 25 / 52 | 40 / 51 | 34 / 45 | 19 / 30 | 18 / 30 |

| Quartile Ranking | 2 | 2 | 4 | 2 | 2 | 3 | 2 | 1 | 1 | 2 | 4 | 4 | 3 | 3 |

| Return % | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 6.23% | 2.97% | -8.52% | 2.97% | 3.44% | 5.60% | 5.61% | 6.33% | -1.29% | -1.31% | -3.30% | 3.78% |

| Benchmark | 3.43% | -0.49% | -7.42% | 2.49% | 3.47% | 5.32% | 11.06% | 4.29% | 0.50% | -1.15% | 5.25% | 1.29% |

26.98% (November 2022)

-17.59% (January 2008)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -0.45% | 30.89% | -5.52% | 8.73% | -4.46% | -4.82% | 2.36% | -8.89% | 17.71% | 20.24% |

| Benchmark | -22.11% | 5.92% | -27.74% | 25.82% | 26.06% | 7.65% | -21.94% | -12.56% | 15.54% | 27.36% |

| Category Average | -0.54% | 36.44% | -10.53% | 17.64% | 16.11% | -9.03% | -16.98% | -15.56% | 17.83% | 26.24% |

| Quartile Ranking | 2 | 3 | 2 | 4 | 4 | 2 | 1 | 1 | 3 | 4 |

| Category Rank | 15/ 30 | 18/ 30 | 12/ 45 | 40/ 50 | 43/ 52 | 19/ 57 | 9/ 57 | 11/ 57 | 37/ 58 | 46/ 59 |

30.89% (2017)

-8.89% (2023)

| Name | Percent |

|---|---|

| International Equity | 97.43 |

| Cash and Equivalents | 2.19 |

| US Equity | 0.37 |

| Foreign Corporate Bonds | 0.01 |

| Name | Percent |

|---|---|

| Technology | 22.60 |

| Consumer Goods | 15.17 |

| Financial Services | 14.60 |

| Consumer Services | 12.22 |

| Real Estate | 8.37 |

| Other | 27.04 |

| Name | Percent |

|---|---|

| Asia | 86.47 |

| Europe | 7.62 |

| North America | 2.43 |

| Other | 3.48 |

| Name | Percent |

|---|---|

| Tencent Holdings Ltd | - |

| Prosus NV | - |

| Trip.com Group Ltd | - |

| Alibaba Group Holding Ltd | - |

| BOC Aviation Ltd | - |

| Ind and Commercial Bank of China Ltd Cl H | - |

| Zijin Mining Group Co Ltd Cl H | - |

| Poly Property Services Co Ltd Cl H | - |

| China Merchants Bank Co Ltd Cl H | - |

| China Construction Bank Corp Cl H | - |

Fidelity China Fund Series B

Median

Other - Greater China Equity

| Standard Deviation | 20.06% | 22.90% | 18.91% |

|---|---|---|---|

| Beta | 0.80% | 0.81% | 0.71% |

| Alpha | 0.02% | 0.04% | 0.04% |

| Rsquared | 0.69% | 0.53% | 0.52% |

| Sharpe | 0.24% | 0.18% | 0.33% |

| Sortino | 0.48% | 0.28% | 0.43% |

| Treynor | 0.06% | 0.05% | 0.09% |

| Tax Efficiency | 87.69% | 80.15% | 89.77% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 15.84% | 20.06% | 22.90% | 18.91% |

| Beta | 0.72% | 0.80% | 0.81% | 0.71% |

| Alpha | 0.02% | 0.02% | 0.04% | 0.04% |

| Rsquared | 0.49% | 0.69% | 0.53% | 0.52% |

| Sharpe | 1.26% | 0.24% | 0.18% | 0.33% |

| Sortino | 2.01% | 0.48% | 0.28% | 0.43% |

| Treynor | 0.28% | 0.06% | 0.05% | 0.09% |

| Tax Efficiency | 98.43% | 87.69% | 80.15% | 89.77% |

| Start Date | May 04, 2006 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | - |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| FID1106 | ||

| FID1206 |

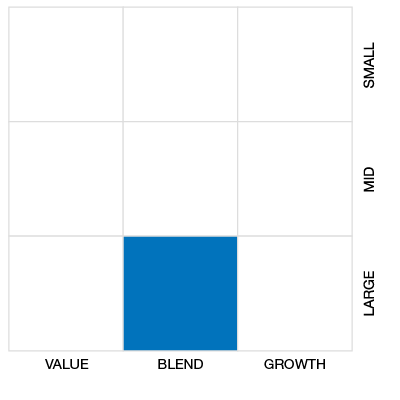

The Fund aims to achieve long-term capital growth. It invests primarily in equity securities of Chinese and Hong Kong companies and in companies located in other countries that derive a significant portion of their revenues from these countries.

To meet the Fund’s objectives, the portfolio management team: When buying and selling equity securities, may consider factors about a company, including: > Financial condition. > Industry position. > Economic and market conditions. > Growth potential. > Earnings estimates. > Cash flow. > Quality of management. May, by situation, consider ESG criteria when evaluating investment opportunities. The Fund may also: Invest in companies of any size, but tends to focus on large companies.

| Portfolio Manager |

Fidelity Investments Canada ULC

|

|---|---|

| Sub-Advisor |

FIL Limited |

| Fund Manager |

Fidelity Investments Canada ULC |

|---|---|

| Custodian |

CIBC Mellon Trust Company State Street Trust Company Canada |

| Registrar |

Fidelity Investments Canada ULC |

| Distributor |

Fidelity Investments Canada ULC |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 500 |

| PAC Subsequent | 25 |

| SWP Allowed | Yes |

| SWP Min Balance | 5,000 |

| SWP Min Withdrawal | 50 |

| MER | 2.23% |

|---|---|

| Management Fee | 1.85% |

| Load | Back Fee Only |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!