Try Fund Library Premium

For Free with a 30 day trial!

Emerging Markets Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (09-17-2025) |

$12.28 |

|---|---|

| Change |

$0.07

(0.56%)

|

As at August 31, 2025

As at July 31, 2025

Inception Return (January 24, 2022): 5.04%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 1.89% | 10.32% | 10.56% | 13.62% | 17.82% | 14.85% | 11.46% | - | - | - | - | - | - | - |

| Benchmark | 1.69% | 8.97% | 9.88% | 10.79% | 19.40% | 17.47% | 13.09% | 5.02% | 7.29% | 7.85% | 6.75% | 6.25% | 7.58% | 8.08% |

| Category Average | 1.98% | 9.62% | 13.25% | 15.64% | 19.10% | 15.47% | 12.50% | 2.41% | 5.72% | 6.57% | 5.29% | 4.69% | 6.03% | 6.47% |

| Category Rank | 178 / 327 | 144 / 326 | 234 / 324 | 203 / 323 | 197 / 320 | 188 / 302 | 192 / 288 | - | - | - | - | - | - | - |

| Quartile Ranking | 3 | 2 | 3 | 3 | 3 | 3 | 3 | - | - | - | - | - | - | - |

| Return % | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 5.64% | -0.36% | -1.89% | 0.41% | 2.48% | 0.28% | 0.34% | -3.98% | 4.02% | 6.01% | 2.14% | 1.89% |

| Benchmark | 7.98% | -0.88% | -2.18% | 2.94% | 1.05% | -0.22% | 0.19% | -3.13% | 3.89% | 3.91% | 3.12% | 1.69% |

13.02% (November 2022)

-6.73% (September 2022)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | - | - | - | - | - | - | - | - | 7.23% | 13.47% |

| Benchmark | 2.69% | 7.90% | 26.42% | -6.05% | 15.55% | 11.45% | 0.08% | -12.38% | 7.03% | 21.65% |

| Category Average | -3.92% | 6.53% | 28.88% | -11.86% | 15.06% | 17.52% | -3.30% | -17.32% | 8.68% | 12.46% |

| Quartile Ranking | - | - | - | - | - | - | - | - | 3 | 3 |

| Category Rank | - | - | - | - | - | - | - | - | 195/ 290 | 175/ 303 |

13.47% (2024)

7.23% (2023)

| Name | Percent |

|---|---|

| International Equity | 98.46 |

| Cash and Equivalents | 0.84 |

| Income Trust Units | 0.44 |

| US Equity | 0.16 |

| Canadian Equity | 0.02 |

| Other | 0.08 |

| Name | Percent |

|---|---|

| Technology | 32.69 |

| Financial Services | 21.40 |

| Consumer Goods | 8.64 |

| Basic Materials | 5.74 |

| Industrial Goods | 5.53 |

| Other | 26.00 |

| Name | Percent |

|---|---|

| Asia | 79.30 |

| Africa and Middle East | 9.62 |

| Latin America | 6.61 |

| Europe | 3.30 |

| North America | 1.38 |

| Name | Percent |

|---|---|

| iShares Core MSCI Emerging Markets ETF (IEMG) | 99.41 |

| Bank of Montreal TD 2.650% Jul 02, 2025 | 0.42 |

| Canadian Dollar | 0.13 |

| Siemens Energy India Ltd | 0.03 |

| Brazilian Real | 0.00 |

| US Dollar | 0.00 |

| Korean Won | 0.00 |

RBC Emerging Markets Equity Index ETF Fund Series A

Median

Other - Emerging Markets Equity

| Standard Deviation | 13.44% | - | - |

|---|---|---|---|

| Beta | 1.02% | - | - |

| Alpha | -0.02% | - | - |

| Rsquared | 0.93% | - | - |

| Sharpe | 0.58% | - | - |

| Sortino | 1.21% | - | - |

| Treynor | 0.08% | - | - |

| Tax Efficiency | - | - | - |

| Volatility |

|

- | - |

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 10.14% | 13.44% | - | - |

| Beta | 0.86% | 1.02% | - | - |

| Alpha | 0.01% | -0.02% | - | - |

| Rsquared | 0.81% | 0.93% | - | - |

| Sharpe | 1.37% | 0.58% | - | - |

| Sortino | 2.92% | 1.21% | - | - |

| Treynor | 0.16% | 0.08% | - | - |

| Tax Efficiency | 96.57% | - | - | - |

| Start Date | January 24, 2022 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | - |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $143 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| RBF1145 |

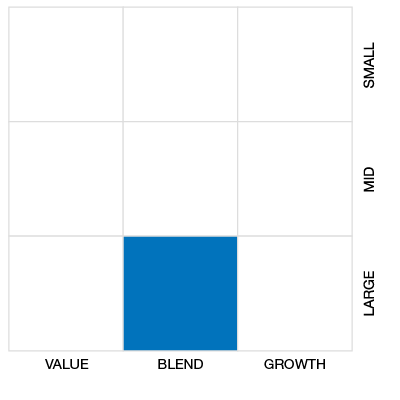

To track the performance of a generally recognized emerging markets equity market index. To provide long-term capital growth. The fund invests primarily in equity securities in substantially the same proportion as its benchmark index, either directly or indirectly through investment in other mutual funds.

To achieve the fund’s objectives, the portfolio manager: manages the fund to track the performance of the MSCI Emerging Markets Investable Market Net Index (or any successor thereto). The MSCI Emerging Markets Investable Market Net Index is designed to represent the after-tax performance of large-, mid- and small-capitalization companies of more than 25 emerging markets countries around the world.

| Portfolio Manager |

RBC Global Asset Management Inc.

|

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

RBC Global Asset Management Inc. |

|---|---|

| Custodian |

RBC Investor Services Trust (Canada) |

| Registrar |

Royal Bank of Canada RBC Global Asset Management Inc. RBC Investor Services Trust (Canada) |

| Distributor |

Royal Mutual Funds Inc. |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | - |

| PAC Subsequent | - |

| SWP Allowed | No |

| SWP Min Balance | - |

| SWP Min Withdrawal | - |

| MER | 1.44% |

|---|---|

| Management Fee | 1.25% |

| Load | No Load |

| FE Max | - |

| DSC Max | - |

| Trailer Fee Max (FE) | - |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | 1.00% |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!