Try Fund Library Premium

For Free with a 30 day trial!

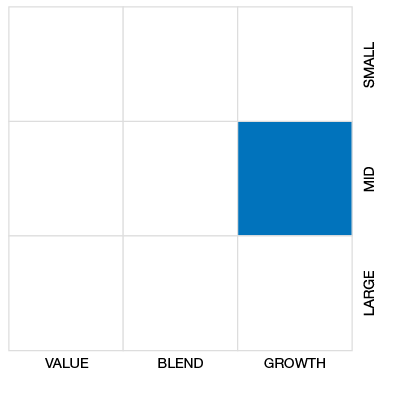

Global Small/Mid Cap Eq

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (10-09-2025) |

$14.59 |

|---|---|

| Change |

$0.03

(0.19%)

|

As at September 30, 2025

As at September 30, 2025

Inception Return (June 21, 2022): 13.04%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 1.45% | 2.93% | 20.32% | 17.71% | 16.84% | 17.41% | 15.74% | - | - | - | - | - | - | - |

| Benchmark | 2.67% | 8.22% | 15.09% | 11.12% | 15.72% | 20.18% | 18.27% | 7.79% | 11.89% | 10.41% | 8.62% | 8.99% | 9.40% | 9.54% |

| Category Average | 1.77% | 5.94% | 14.55% | 11.88% | 11.47% | 16.72% | 15.54% | 4.83% | 9.15% | 8.74% | 6.48% | 6.39% | 6.76% | 6.68% |

| Category Rank | 152 / 281 | 214 / 281 | 40 / 275 | 55 / 273 | 62 / 272 | 127 / 260 | 139 / 242 | - | - | - | - | - | - | - |

| Quartile Ranking | 3 | 4 | 1 | 1 | 1 | 2 | 3 | - | - | - | - | - | - | - |

| Return % | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -2.08% | 0.02% | 1.34% | 7.14% | -2.78% | -6.07% | 3.61% | 7.16% | 5.28% | -0.91% | 2.38% | 1.45% |

| Benchmark | 0.86% | 6.51% | -3.05% | 4.42% | -3.55% | -4.14% | -3.02% | 5.68% | 3.76% | 2.68% | 2.65% | 2.67% |

12.98% (November 2022)

-6.95% (September 2023)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | - | - | - | - | - | - | - | - | 11.33% | 5.30% |

| Benchmark | 16.61% | 7.47% | 15.40% | -7.34% | 20.09% | 11.07% | 15.50% | -13.14% | 14.59% | 18.68% |

| Category Average | 9.56% | 3.48% | 12.62% | -10.42% | 13.76% | 14.53% | 12.37% | -15.59% | 12.82% | 12.04% |

| Quartile Ranking | - | - | - | - | - | - | - | - | 3 | 3 |

| Category Rank | - | - | - | - | - | - | - | - | 142/ 242 | 189/ 260 |

11.33% (2023)

5.30% (2024)

| Name | Percent |

|---|---|

| International Equity | 93.06 |

| Canadian Equity | 3.75 |

| Cash and Equivalents | 3.18 |

| Other | 0.01 |

| Name | Percent |

|---|---|

| Technology | 30.02 |

| Industrial Goods | 18.35 |

| Financial Services | 14.28 |

| Exchange Traded Fund | 8.11 |

| Consumer Goods | 7.47 |

| Other | 21.77 |

| Name | Percent |

|---|---|

| Asia | 45.86 |

| Europe | 35.84 |

| Multi-National | 8.11 |

| North America | 6.94 |

| Africa and Middle East | 1.65 |

| Other | 1.60 |

| Name | Percent |

|---|---|

| iShares ESG Advanced MSCI EAFE ETF (DMXF) | 8.11 |

| Chroma ATE Inc | 4.89 |

| Johnson Electric Holdings Ltd | 4.46 |

| Aspeed Technology Inc | 3.61 |

| AUTO1 Group SE | 3.35 |

| Alpha FX Group PLC | 3.25 |

| Cash and Cash Equivalents | 3.18 |

| Games Workshop Group PLC | 2.79 |

| Technogym SpA | 2.72 |

| Kinaxis Inc | 2.65 |

Desjardins Sustainable International Small Cap Equity Fund Class A

Median

Other - Global Small/Mid Cap Eq

| Standard Deviation | 15.64% | - | - |

|---|---|---|---|

| Beta | 0.82% | - | - |

| Alpha | 0.01% | - | - |

| Rsquared | 0.48% | - | - |

| Sharpe | 0.76% | - | - |

| Sortino | 1.60% | - | - |

| Treynor | 0.14% | - | - |

| Tax Efficiency | - | - | - |

| Volatility |

|

- | - |

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 14.00% | 15.64% | - | - |

| Beta | 0.61% | 0.82% | - | - |

| Alpha | 0.07% | 0.01% | - | - |

| Rsquared | 0.33% | 0.48% | - | - |

| Sharpe | 0.97% | 0.76% | - | - |

| Sortino | 1.81% | 1.60% | - | - |

| Treynor | 0.22% | 0.14% | - | - |

| Tax Efficiency | 95.89% | - | - | - |

| Start Date | June 21, 2022 |

|---|---|

| Instrument Type | Mutual Fund (Responsible Investment) |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $46 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| DJT00129 |

The objective of this Fund is to provide a long-term capital appreciation by investing primarily in equity and equity-related securities of small-capitalization companies located or operating throughout the world, apart from the United States. The Fund follows the responsible approach to investing.

The sub-manager employs a bottom-up approach to stock selection and principally selects companies without being constrained by the Fund’s benchmark, which is the MSCI ACWI ex USA Small Cap Index benchmark. It focuses on company research and the long-term outlook of companies. Stock ideas are normally researched to assess a range of factors, including: long-term growth potential, geographic and industry positioning, competitive advantage, management, financial strength and valuation.

| Portfolio Manager |

Desjardins Global Asset Management Inc. |

|---|---|

| Sub-Advisor |

Baillie Gifford Overseas Limited

|

| Fund Manager |

Desjardins Investments Inc. |

|---|---|

| Custodian |

Desjardins Trust Inc. |

| Registrar |

- |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 25 |

| PAC Subsequent | 25 |

| SWP Allowed | Yes |

| SWP Min Balance | 1,000 |

| SWP Min Withdrawal | 100 |

| MER | 2.47% |

|---|---|

| Management Fee | 1.93% |

| Load | No Load |

| FE Max | - |

| DSC Max | - |

| Trailer Fee Max (FE) | - |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | 1.00% |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!