Try Fund Library Premium

For Free with a 30 day trial!

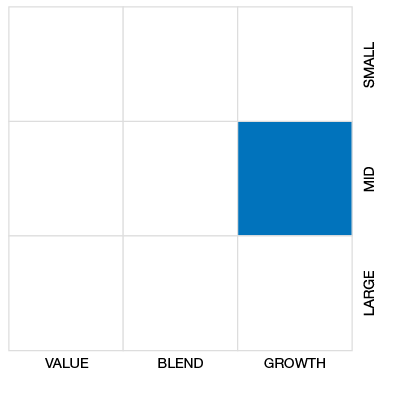

Cdn Small/Mid Cap Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (11-04-2025) |

$56.83 |

|---|---|

| Change |

-$1.88

(-3.20%)

|

As at September 30, 2025

As at September 30, 2025

Inception Return (November 12, 1986): 7.93%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 7.01% | 14.40% | 29.91% | 27.50% | 33.33% | 29.24% | 22.68% | 13.87% | 18.13% | 17.02% | 14.39% | 12.45% | 10.34% | 11.22% |

| Benchmark | 8.91% | 20.86% | 35.07% | 36.26% | 37.20% | 30.99% | 22.51% | 12.22% | 17.98% | 14.21% | 10.97% | 9.55% | 8.59% | 11.04% |

| Category Average | 4.56% | 10.18% | 23.20% | 18.11% | 20.23% | 21.59% | 16.40% | 7.43% | 12.88% | 11.07% | 8.54% | 7.88% | 7.29% | 8.22% |

| Category Rank | 65 / 197 | 51 / 197 | 48 / 196 | 15 / 196 | 12 / 196 | 28 / 192 | 20 / 192 | 13 / 189 | 20 / 176 | 8 / 175 | 10 / 166 | 13 / 162 | 28 / 154 | 25 / 132 |

| Quartile Ranking | 2 | 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Return % | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 2.48% | 4.95% | -2.76% | 0.63% | -2.48% | 0.02% | -0.55% | 6.70% | 7.01% | 0.64% | 6.23% | 7.01% |

| Benchmark | 1.39% | 2.69% | -3.30% | 0.65% | -2.27% | 2.56% | -1.83% | 7.20% | 6.19% | 1.50% | 9.34% | 8.91% |

23.09% (April 2020)

-24.43% (October 1987)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -7.83% | 18.73% | -1.86% | -17.91% | 25.11% | 23.04% | 18.80% | -2.52% | 6.21% | 24.64% |

| Benchmark | -13.31% | 38.48% | 2.75% | -18.17% | 15.84% | 12.87% | 20.27% | -9.29% | 4.79% | 18.83% |

| Category Average | -6.13% | 18.01% | 3.43% | -15.15% | 16.59% | 11.91% | 22.35% | -11.32% | 6.49% | 16.84% |

| Quartile Ranking | 4 | 3 | 4 | 4 | 2 | 1 | 4 | 1 | 3 | 1 |

| Category Rank | 98/ 127 | 90/ 149 | 141/ 154 | 124/ 163 | 44/ 170 | 22/ 175 | 151/ 182 | 27/ 190 | 110/ 192 | 23/ 193 |

25.11% (2019)

-17.91% (2018)

| Name | Percent |

|---|---|

| Canadian Equity | 90.65 |

| Income Trust Units | 4.14 |

| Cash and Equivalents | 2.90 |

| US Equity | 1.41 |

| International Equity | 0.90 |

| Name | Percent |

|---|---|

| Basic Materials | 33.36 |

| Energy | 12.55 |

| Financial Services | 11.21 |

| Industrial Goods | 9.60 |

| Technology | 7.08 |

| Other | 26.20 |

| Name | Percent |

|---|---|

| North America | 99.10 |

| Asia | 0.90 |

| Name | Percent |

|---|---|

| Celestica Inc | 3.30 |

| Fairfax Financial Holdings Ltd | 3.16 |

| Cash and Cash Equivalents | 2.90 |

| Chartwell Retirement Residences - Units | 2.53 |

| Torex Gold Resources Inc | 2.48 |

| Pan American Silver Corp | 2.23 |

| Athabasca Oil Corp | 2.14 |

| Orla Mining Ltd | 2.00 |

| MDA Space Ltd | 1.91 |

| Spartan Delta Corp | 1.88 |

TD Canadian Small-Cap Equity Fund Investor Series

Median

Other - Cdn Small/Mid Cap Equity

| Standard Deviation | 11.72% | 13.19% | 15.91% |

|---|---|---|---|

| Beta | 0.78% | 0.72% | 0.76% |

| Alpha | 0.05% | 0.05% | 0.02% |

| Rsquared | 0.87% | 0.88% | 0.92% |

| Sharpe | 1.47% | 1.14% | 0.64% |

| Sortino | 3.61% | 2.03% | 0.88% |

| Treynor | 0.22% | 0.21% | 0.13% |

| Tax Efficiency | 93.21% | 88.51% | 88.07% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 12.92% | 11.72% | 13.19% | 15.91% |

| Beta | 0.81% | 0.78% | 0.72% | 0.76% |

| Alpha | 0.03% | 0.05% | 0.05% | 0.02% |

| Rsquared | 0.86% | 0.87% | 0.88% | 0.92% |

| Sharpe | 2.08% | 1.47% | 1.14% | 0.64% |

| Sortino | 6.47% | 3.61% | 2.03% | 0.88% |

| Treynor | 0.33% | 0.22% | 0.21% | 0.13% |

| Tax Efficiency | 96.17% | 93.21% | 88.51% | 88.07% |

| Start Date | November 12, 1986 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Quarterly |

| Assets ($mil) | $915 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| TDB628 |

The fundamental investment objective is to seek to achieve long-term capital growth by investing primarily in equity securities of small or medium-sized issuers in Canada. The fundamental investment objective may only be changed with the approval of a majority of unitholders, given at a meeting called for that purpose.

The portfolio adviser seeks to achieve the fundamental investment objective of the Fund by selecting securities based on company fundamentals, including the prospect for growth in sales and profitability, as well as the relative attractiveness of the securities’ price. Both growth and value stocks will be purchased in the Fund, consistent with an overall growth-at-a-reasonable-price orientation.

| Portfolio Manager |

TD Asset Management Inc. |

|---|---|

| Sub-Advisor |

Connor, Clark & Lunn Investment Management Ltd.

|

| Fund Manager |

TD Asset Management Inc. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

The Toronto-Dominion Bank |

| Distributor |

TD Investment Services Inc |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | - |

| PAC Subsequent | - |

| SWP Allowed | Yes |

| SWP Min Balance | 10,000 |

| SWP Min Withdrawal | 100 |

| MER | 2.42% |

|---|---|

| Management Fee | 2.00% |

| Load | No Load |

| FE Max | - |

| DSC Max | - |

| Trailer Fee Max (FE) | - |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | 1.00% |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!