Try Fund Library Premium

For Free with a 30 day trial!

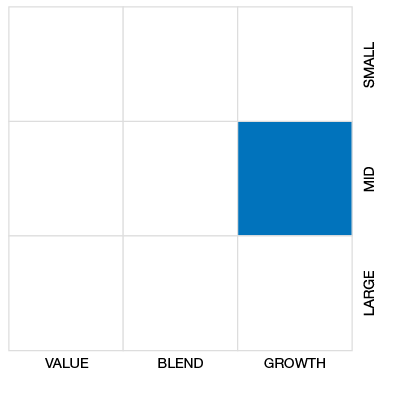

Cdn Small/Mid Cap Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (02-04-2026) |

$19.36 |

|---|---|

| Change |

$0.17

(0.90%)

|

As at December 31, 2025

As at December 31, 2025

Inception Return (June 16, 2003): 7.86%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 2.03% | 4.02% | 14.27% | 23.80% | 23.80% | 18.29% | 13.57% | 7.13% | 9.58% | 10.64% | 12.26% | 7.78% | 7.58% | 8.21% |

| Benchmark | 2.39% | 10.22% | 33.22% | 50.19% | 50.19% | 33.59% | 23.21% | 14.13% | 15.33% | 14.92% | 15.05% | 10.25% | 9.39% | 12.00% |

| Category Average | 2.62% | 5.45% | 16.19% | 24.55% | 24.55% | 20.63% | 15.72% | 8.27% | 10.95% | 11.11% | 11.88% | 8.08% | 7.55% | 8.55% |

| Category Rank | 108 / 198 | 133 / 197 | 117 / 197 | 99 / 196 | 99 / 196 | 133 / 193 | 145 / 192 | 110 / 190 | 130 / 182 | 119 / 175 | 97 / 170 | 113 / 163 | 98 / 154 | 104 / 149 |

| Quartile Ranking | 3 | 3 | 3 | 3 | 3 | 3 | 4 | 3 | 3 | 3 | 3 | 3 | 3 | 3 |

| Return % | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -0.59% | -1.23% | -3.01% | -1.34% | 9.97% | 4.85% | 1.65% | 4.54% | 3.39% | 0.42% | 1.52% | 2.03% |

| Benchmark | 0.65% | -2.27% | 2.56% | -1.83% | 7.20% | 6.19% | 1.50% | 9.34% | 8.91% | 2.30% | 5.23% | 2.39% |

16.31% (April 2020)

-24.32% (March 2020)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 14.03% | 6.04% | -19.00% | 22.51% | 16.09% | 19.99% | -10.09% | 4.69% | 13.02% | 23.80% |

| Benchmark | 38.48% | 2.75% | -18.17% | 15.84% | 12.87% | 20.27% | -9.29% | 4.79% | 18.83% | 50.19% |

| Category Average | 18.01% | 3.43% | -15.15% | 16.59% | 11.91% | 22.35% | -11.32% | 6.49% | 16.84% | 24.55% |

| Quartile Ranking | 3 | 2 | 4 | 2 | 2 | 3 | 2 | 3 | 4 | 3 |

| Category Rank | 110/ 149 | 44/ 154 | 139/ 163 | 61/ 170 | 80/ 175 | 135/ 182 | 78/ 190 | 125/ 192 | 182/ 193 | 99/ 196 |

23.80% (2025)

-19.00% (2018)

| Name | Percent |

|---|---|

| Canadian Equity | 86.89 |

| International Equity | 5.49 |

| Income Trust Units | 5.48 |

| US Equity | 1.35 |

| Cash and Equivalents | 0.80 |

| Name | Percent |

|---|---|

| Real Estate | 18.00 |

| Energy | 16.39 |

| Basic Materials | 13.56 |

| Consumer Goods | 12.75 |

| Financial Services | 12.41 |

| Other | 26.89 |

| Name | Percent |

|---|---|

| North America | 94.51 |

| Asia | 3.56 |

| Europe | 1.93 |

| Name | Percent |

|---|---|

| Aritzia Inc | 5.84 |

| Groupe Dynamite Inc | 5.24 |

| Element Fleet Management Corp | 3.93 |

| Badger Infrastructure Solutions Ltd | 3.90 |

| Atkinsrealis Group Inc | 3.82 |

| OceanaGold Corp | 3.56 |

| Morguard Corp | 2.94 |

| Trisura Group Ltd | 2.93 |

| Flagship Communities REIT - Units | 2.51 |

| Tamarack Valley Energy Ltd | 2.43 |

AGF Canadian Small Cap Fund Mutual Fund Series

Median

Other - Cdn Small/Mid Cap Equity

| Standard Deviation | 11.10% | 12.67% | 15.25% |

|---|---|---|---|

| Beta | 0.62% | 0.65% | 0.67% |

| Alpha | 0.00% | 0.00% | 0.00% |

| Rsquared | 0.59% | 0.64% | 0.76% |

| Sharpe | 0.86% | 0.57% | 0.48% |

| Sortino | 1.95% | 0.87% | 0.57% |

| Treynor | 0.15% | 0.11% | 0.11% |

| Tax Efficiency | 100.00% | 100.00% | 100.00% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 12.18% | 11.10% | 12.67% | 15.25% |

| Beta | 0.67% | 0.62% | 0.65% | 0.67% |

| Alpha | -0.06% | 0.00% | 0.00% | 0.00% |

| Rsquared | 0.54% | 0.59% | 0.64% | 0.76% |

| Sharpe | 1.61% | 0.86% | 0.57% | 0.48% |

| Sortino | 4.79% | 1.95% | 0.87% | 0.57% |

| Treynor | 0.29% | 0.15% | 0.11% | 0.11% |

| Tax Efficiency | 100.00% | 100.00% | 100.00% | 100.00% |

| Start Date | June 16, 2003 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $183 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| AGF259 | ||

| AGF696 | ||

| AGF796 |

The Fund’s objective is to provide superior capital growth. It invests primarily in shares and other securities of small and medium Canadian companies that have the potential to generate above-average growth.

The portfolio manager uses a fundamental bottom-up investment process to identify attractive businesses trading at reasonable valuations. This core investment process is complemented by top-down macroeconomic and industry outlooks. The portfolio manager may develop strong views concerning certain macro or industry factors, in which case sector weights are adjusted to compensate for the expected opportunities/risks.

| Portfolio Manager |

Cypress Capital Management Ltd.

|

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

AGF Investments Inc. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

AGF Investments Inc. |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 25 |

| PAC Subsequent | 25 |

| SWP Allowed | Yes |

| SWP Min Balance | 0 |

| SWP Min Withdrawal | 0 |

| MER | 2.82% |

|---|---|

| Management Fee | 2.25% |

| Load | Choice of Front or No Load |

| FE Max | 6.00% |

| DSC Max | 5.50% |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | 1.00% |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!