Try Fund Library Premium

For Free with a 30 day trial!

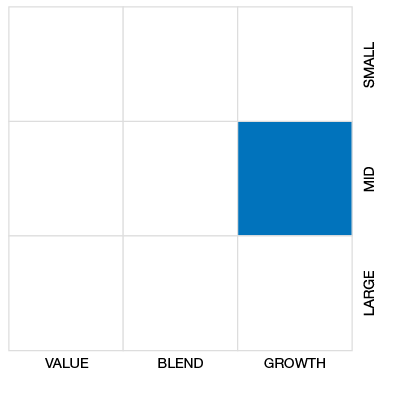

U.S. Small/Mid Cap Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (08-22-2025) |

$59.36 |

|---|---|

| Change |

$1.67

(2.90%)

|

As at July 31, 2025

As at June 30, 2025

Inception Return (August 29, 2002): 7.83%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 1.68% | 8.76% | -8.75% | -3.80% | 0.99% | 8.44% | 8.85% | 4.49% | 9.45% | 6.16% | 5.08% | 5.94% | 6.64% | 5.94% |

| Benchmark | 3.25% | 13.02% | -4.83% | 0.55% | 9.23% | 13.49% | 12.63% | 7.11% | 12.31% | 9.86% | 8.80% | 10.17% | 10.11% | 9.04% |

| Category Average | 1.42% | 9.69% | -6.84% | -2.43% | -0.84% | 6.96% | 5.90% | 1.81% | 7.80% | 5.22% | 4.05% | 5.16% | 5.78% | 5.23% |

| Category Rank | 138 / 296 | 223 / 295 | 188 / 295 | 163 / 294 | 86 / 270 | 84 / 264 | 65 / 258 | 51 / 244 | 73 / 226 | 92 / 197 | 98 / 187 | 101 / 174 | 85 / 160 | 75 / 146 |

| Quartile Ranking | 2 | 4 | 3 | 3 | 2 | 2 | 2 | 1 | 2 | 2 | 3 | 3 | 3 | 3 |

| Return % | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -2.04% | 1.37% | 0.63% | 11.12% | -5.46% | 5.42% | -4.69% | -6.89% | -5.46% | 4.73% | 2.14% | 1.68% |

| Benchmark | -1.81% | 2.68% | 2.75% | 10.22% | -4.86% | 5.64% | -5.13% | -6.25% | -5.32% | 5.58% | 3.68% | 3.25% |

16.93% (April 2020)

-24.73% (March 2020)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 2.45% | 14.63% | 7.12% | -6.89% | 14.41% | 4.21% | 18.61% | -12.22% | 12.42% | 19.47% |

| Benchmark | 11.76% | 14.08% | 8.66% | -2.87% | 21.65% | 11.78% | 20.00% | -11.77% | 13.76% | 24.39% |

| Category Average | 6.25% | 9.80% | 10.84% | -7.63% | 15.90% | 4.61% | 23.16% | -17.30% | 11.64% | 13.19% |

| Quartile Ranking | 4 | 2 | 3 | 3 | 4 | 4 | 3 | 1 | 2 | 1 |

| Category Rank | 113/ 139 | 44/ 158 | 115/ 162 | 116/ 182 | 172/ 193 | 159/ 200 | 181/ 244 | 41/ 246 | 105/ 264 | 56/ 268 |

19.47% (2024)

-12.22% (2022)

| Name | Percent |

|---|---|

| US Equity | 95.66 |

| International Equity | 2.09 |

| Canadian Equity | 1.40 |

| Cash and Equivalents | 0.86 |

| Name | Percent |

|---|---|

| Financial Services | 19.41 |

| Industrial Goods | 15.27 |

| Healthcare | 15.02 |

| Technology | 10.93 |

| Consumer Goods | 8.45 |

| Other | 30.92 |

| Name | Percent |

|---|---|

| North America | 97.92 |

| Europe | 1.29 |

| Latin America | 0.80 |

| Name | Percent |

|---|---|

| AutoNation Inc | 2.21 |

| Itron Inc | 2.12 |

| Wintrust Financial Corp | 1.94 |

| Casella Waste Systems Inc Cl A | 1.81 |

| Zurn Water Solutions Corp | 1.69 |

| Belden Inc | 1.65 |

| ESAB Corp | 1.60 |

| PennyMac Financial Services Inc | 1.60 |

| EnPro Industries Inc | 1.58 |

| American Healthcare REIT Inc | 1.54 |

Invesco Main Street U.S. Small Cap Class Series A

Median

Other - U.S. Small/Mid Cap Equity

| Standard Deviation | 17.65% | 17.01% | 17.55% |

|---|---|---|---|

| Beta | 1.00% | 0.98% | 0.99% |

| Alpha | -0.03% | -0.02% | -0.03% |

| Rsquared | 0.93% | 0.92% | 0.89% |

| Sharpe | 0.34% | 0.47% | 0.32% |

| Sortino | 0.66% | 0.73% | 0.36% |

| Treynor | 0.06% | 0.08% | 0.06% |

| Tax Efficiency | 99.92% | 99.94% | 99.94% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 18.62% | 17.65% | 17.01% | 17.55% |

| Beta | 0.99% | 1.00% | 0.98% | 0.99% |

| Alpha | -0.08% | -0.03% | -0.02% | -0.03% |

| Rsquared | 0.97% | 0.93% | 0.92% | 0.89% |

| Sharpe | -0.03% | 0.34% | 0.47% | 0.32% |

| Sortino | -0.04% | 0.66% | 0.73% | 0.36% |

| Treynor | -0.01% | 0.06% | 0.08% | 0.06% |

| Tax Efficiency | 99.52% | 99.92% | 99.94% | 99.94% |

| Start Date | August 29, 2002 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Corporation |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $115 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| AIM5521 | ||

| AIM5523 | ||

| AIM5525 | ||

| AIM5529 |

Invesco Main Street U.S. Small Cap Class seeks to provide strong capital growth over the long term. The Fund invests mainly in common shares of a diversified group of U.S. companies with small market capitalizations. The investment objectives of the Fund cannot be changed without the approval of a majority of the investors at a meeting called to consider the change.

To achieve these objectives, the portfolio management team constructs and monitors the portfolio based upon several analytical tools, including quantitative investment models. These models are used to rank securities within each sector with a view to identifying potential candidates for further fundamental analysis.

| Portfolio Manager |

Invesco Canada Ltd.

|

|---|---|

| Sub-Advisor |

Invesco Advisers Inc. |

| Fund Manager |

Invesco Canada Ltd. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

Invesco Canada Ltd. |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 50 |

| PAC Subsequent | 50 |

| SWP Allowed | Yes |

| SWP Min Balance | 5,000 |

| SWP Min Withdrawal | 50 |

| MER | 2.94% |

|---|---|

| Management Fee | 2.00% |

| Load | Choice of Front or No Load |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | 1.00% |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!