Try Fund Library Premium

For Free with a 30 day trial!

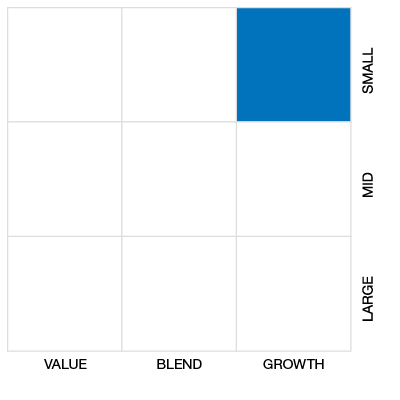

Cdn Small/Mid Cap Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

2017, 2016, 2014, 2013

Click for more information on Fundata’s FundGrade

|

NAVPS (01-26-2026) |

$44.27 |

|---|---|

| Change |

-$0.24

(-0.54%)

|

As at December 31, 2025

As at November 30, 2025

Inception Return (January 11, 1995): 10.32%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 2.63% | 5.11% | 10.07% | 20.54% | 20.54% | 16.80% | 14.55% | 10.69% | 13.43% | 11.39% | 11.90% | 8.70% | 7.95% | 9.37% |

| Benchmark | 2.39% | 10.22% | 33.22% | 50.19% | 50.19% | 33.59% | 23.21% | 14.13% | 15.33% | 14.92% | 15.05% | 10.25% | 9.39% | 12.00% |

| Category Average | 2.62% | 5.45% | 16.19% | 24.55% | 24.55% | 20.63% | 15.72% | 8.27% | 10.95% | 11.11% | 11.88% | 8.08% | 7.55% | 8.55% |

| Category Rank | 99 / 198 | 106 / 197 | 153 / 197 | 141 / 196 | 141 / 196 | 150 / 193 | 123 / 192 | 63 / 190 | 57 / 182 | 93 / 175 | 106 / 170 | 89 / 163 | 87 / 154 | 72 / 149 |

| Quartile Ranking | 2 | 3 | 4 | 3 | 3 | 4 | 3 | 2 | 2 | 3 | 3 | 3 | 3 | 2 |

| Return % | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 0.86% | -2.97% | -0.97% | 1.76% | 7.11% | 3.68% | -1.63% | 4.99% | 1.40% | 0.54% | 1.87% | 2.63% |

| Benchmark | 0.65% | -2.27% | 2.56% | -1.83% | 7.20% | 6.19% | 1.50% | 9.34% | 8.91% | 2.30% | 5.23% | 2.39% |

14.04% (February 2000)

-26.11% (March 2020)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 23.03% | 2.12% | -11.29% | 15.02% | 1.72% | 25.10% | -0.11% | 10.16% | 13.18% | 20.54% |

| Benchmark | 38.48% | 2.75% | -18.17% | 15.84% | 12.87% | 20.27% | -9.29% | 4.79% | 18.83% | 50.19% |

| Category Average | 18.01% | 3.43% | -15.15% | 16.59% | 11.91% | 22.35% | -11.32% | 6.49% | 16.84% | 24.55% |

| Quartile Ranking | 2 | 3 | 1 | 4 | 4 | 2 | 1 | 2 | 4 | 3 |

| Category Rank | 43/ 149 | 89/ 154 | 32/ 163 | 146/ 170 | 155/ 175 | 63/ 182 | 21/ 190 | 66/ 192 | 175/ 193 | 141/ 196 |

25.10% (2021)

-11.29% (2018)

| Name | Percent |

|---|---|

| Canadian Equity | 88.92 |

| Cash and Equivalents | 5.38 |

| US Equity | 4.79 |

| Income Trust Units | 0.90 |

| Other | 0.01 |

| Name | Percent |

|---|---|

| Financial Services | 16.14 |

| Industrial Services | 13.49 |

| Consumer Services | 12.86 |

| Basic Materials | 10.62 |

| Consumer Goods | 9.16 |

| Other | 37.73 |

| Name | Percent |

|---|---|

| North America | 100.00 |

| Name | Percent |

|---|---|

| Aritzia Inc | 4.85 |

| AltaGas Ltd | 4.53 |

| Mullen Group Ltd | 4.47 |

| Winpak Ltd | 4.42 |

| Sunococorp | 4.36 |

| US Dollar | 4.21 |

| Information Services Corp Cl A | 4.16 |

| Lassonde Industries Inc Cl A | 4.15 |

| Pet Valu Holdings Ltd | 3.95 |

| Definity Financial Corp | 3.84 |

NEI Canadian Small Cap Equity RS Fund Series A

Median

Other - Cdn Small/Mid Cap Equity

| Standard Deviation | 9.09% | 10.57% | 14.05% |

|---|---|---|---|

| Beta | 0.41% | 0.50% | 0.60% |

| Alpha | 0.05% | 0.05% | 0.02% |

| Rsquared | 0.39% | 0.54% | 0.73% |

| Sharpe | 1.12% | 0.99% | 0.58% |

| Sortino | 2.68% | 1.77% | 0.69% |

| Treynor | 0.25% | 0.21% | 0.14% |

| Tax Efficiency | 95.60% | 93.86% | 91.44% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 9.74% | 9.09% | 10.57% | 14.05% |

| Beta | 0.50% | 0.41% | 0.50% | 0.60% |

| Alpha | -0.02% | 0.05% | 0.05% | 0.02% |

| Rsquared | 0.47% | 0.39% | 0.54% | 0.73% |

| Sharpe | 1.71% | 1.12% | 0.99% | 0.58% |

| Sortino | 4.14% | 2.68% | 1.77% | 0.69% |

| Treynor | 0.33% | 0.25% | 0.21% | 0.14% |

| Tax Efficiency | 98.20% | 95.60% | 93.86% | 91.44% |

| Start Date | January 11, 1995 |

|---|---|

| Instrument Type | Mutual Fund (Responsible Investment) |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $721 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| NWT067 | ||

| NWT267 |

The Fund aims to increase the value of your investment over the long-term by investing mostly in common shares of small capitalization or “small cap” Canadian companies listed on a stock exchange. The Fund follows a responsible approach to investing, as described on pages 74 to 79 of this prospectus. Unitholder approval (by a majority of votes cast at a meeting of unitholders) is required prior to a fundamental change of investment objectives.

The Portfolio Manager invests mostly in small cap companies having a market capitalization at the time of investment between $100 million and $2.5 billion. The Portfolio Manager uses a fundamental research approach, employing a bottom-up stock selection process that includes company visits and management interviews.

| Portfolio Manager |

Northwest & Ethical Investments L.P.

|

|---|---|

| Sub-Advisor |

QV Investors Inc.

|

| Fund Manager |

Northwest & Ethical Investments L.P. |

|---|---|

| Custodian |

Desjardins Trust Inc. |

| Registrar |

Northwest & Ethical Investments L.P. |

| Distributor |

Aviso Financial Inc. |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 500 |

| PAC Subsequent | 25 |

| SWP Allowed | Yes |

| SWP Min Balance | 5,000 |

| SWP Min Withdrawal | 100 |

| MER | 2.70% |

|---|---|

| Management Fee | 2.10% |

| Load | Choice of Back or No Load |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!