Try Fund Library Premium

For Free with a 30 day trial!

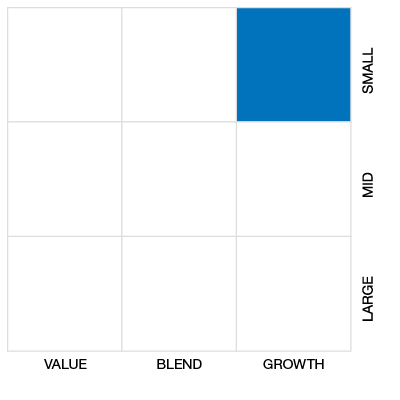

Cdn Foc Small/Mid Cap Eq

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

2018, 2017, 2016, 2015, 2014

Click for more information on Fundata’s FundGrade

|

NAVPS (03-06-2026) |

$40.64 |

|---|---|

| Change |

-$0.55

(-1.34%)

|

As at January 31, 2026

As at January 31, 2026

Inception Return (June 01, 2009): 15.13%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 7.57% | 5.50% | 9.15% | 7.57% | 14.30% | 31.19% | 20.87% | 9.30% | 8.88% | 15.03% | 15.21% | 10.96% | 10.78% | 13.11% |

| Benchmark | 6.98% | 12.32% | 30.53% | 6.98% | 42.45% | 31.91% | 19.88% | 14.61% | 14.57% | 14.82% | 13.71% | 10.77% | 10.25% | 12.46% |

| Category Average | 1.99% | 3.14% | 6.74% | 1.99% | 9.78% | 14.13% | 10.76% | 6.72% | 6.78% | 10.43% | 10.92% | 8.69% | 9.04% | 10.21% |

| Category Rank | 4 / 48 | 13 / 48 | 11 / 48 | 4 / 48 | 11 / 48 | 4 / 48 | 4 / 48 | 11 / 48 | 20 / 48 | 8 / 48 | 5 / 45 | 5 / 36 | 3 / 35 | 3 / 34 |

| Quartile Ranking | 1 | 2 | 1 | 1 | 1 | 1 | 1 | 1 | 2 | 1 | 1 | 1 | 1 | 1 |

| Return % | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -6.14% | -4.78% | 1.19% | 4.80% | 4.44% | 5.80% | 0.50% | 1.90% | 1.03% | -6.23% | 4.59% | 7.57% |

| Benchmark | -2.72% | 0.21% | -2.24% | 6.67% | 5.34% | 1.91% | 7.00% | 6.73% | 1.77% | 3.68% | 1.26% | 6.98% |

18.93% (November 2020)

-28.82% (March 2020)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 26.10% | 8.48% | -16.34% | 19.23% | 46.34% | 24.71% | -29.26% | 5.05% | 57.21% | 4.64% |

| Benchmark | 27.23% | 7.15% | -14.41% | 17.42% | 12.92% | 18.74% | -10.51% | 8.17% | 18.86% | 35.78% |

| Category Average | 16.27% | 9.79% | -11.20% | 21.83% | 30.06% | 13.94% | -13.64% | 7.90% | 18.68% | 9.65% |

| Quartile Ranking | 1 | 3 | 4 | 3 | 1 | 1 | 4 | 3 | 1 | 4 |

| Category Rank | 2/ 34 | 22/ 35 | 34/ 36 | 23/ 39 | 3/ 48 | 11/ 48 | 48/ 48 | 32/ 48 | 4/ 48 | 43/ 48 |

57.21% (2024)

-29.26% (2022)

| Name | Percent |

|---|---|

| Canadian Equity | 80.36 |

| US Equity | 14.11 |

| International Equity | 4.79 |

| Foreign Corporate Bonds | 0.75 |

| Name | Percent |

|---|---|

| Technology | 28.43 |

| Basic Materials | 15.36 |

| Industrial Goods | 14.07 |

| Energy | 6.99 |

| Utilities | 6.97 |

| Other | 28.18 |

| Name | Percent |

|---|---|

| North America | 95.22 |

| Europe | 4.78 |

| Name | Percent |

|---|---|

| Tantalus Systems Holding Inc | 5.12 |

| GENERAL FUSION SAFE | 4.80 |

| Coveo Solutions Inc | 4.34 |

| 5N Plus Inc | 4.19 |

| PAR Technology Corp | 4.01 |

| Kraken Robotics Inc | 3.90 |

| NFI Group Inc | 3.89 |

| Kneat.com Inc | 3.56 |

| Zedcor Inc | 3.33 |

| Vitalhub Corp | 3.27 |

Pender Small Cap Opportunities Fund Class A

Median

Other - Cdn Foc Small/Mid Cap Eq

| Standard Deviation | 15.67% | 17.23% | 19.51% |

|---|---|---|---|

| Beta | 0.75% | 0.79% | 0.86% |

| Alpha | 0.06% | -0.02% | 0.03% |

| Rsquared | 0.34% | 0.42% | 0.56% |

| Sharpe | 1.05% | 0.42% | 0.64% |

| Sortino | 1.92% | 0.59% | 0.85% |

| Treynor | 0.22% | 0.09% | 0.15% |

| Tax Efficiency | 93.90% | 78.73% | 86.68% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 16.27% | 15.67% | 17.23% | 19.51% |

| Beta | 0.64% | 0.75% | 0.79% | 0.86% |

| Alpha | -0.09% | 0.06% | -0.02% | 0.03% |

| Rsquared | 0.23% | 0.34% | 0.42% | 0.56% |

| Sharpe | 0.75% | 1.05% | 0.42% | 0.64% |

| Sortino | 1.12% | 1.92% | 0.59% | 0.85% |

| Treynor | 0.19% | 0.22% | 0.09% | 0.15% |

| Tax Efficiency | 79.31% | 93.90% | 78.73% | 86.68% |

| Start Date | June 01, 2009 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Capped |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $439 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| PGF315 |

The Fund invests in a concentrated portfolio of well-managed businesses, with strong competitive positions, which are overlooked by the market and have the potential for significant capital appreciation. These businesses may be in Canada, the United States or in other foreign jurisdictions with a primary emphasis on companies with a small market capitalization.

The Manager will examine each potential investment for success in light of current economic and market conditions, its industry position, its current financial position, its growth potential, earnings estimates and the quality of its management. The Manager will focus on small and medium-sized businesses that have the potential for growth over the long term and whose shares trade at prices reflecting favourable valuations at a discount to their intrinsic value.

| Portfolio Manager |

PenderFund Capital Management Ltd.

|

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

PenderFund Capital Management Ltd. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

CIBC Mellon Trust Company |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 0 |

| PAC Subsequent | 0 |

| SWP Allowed | No |

| SWP Min Balance | - |

| SWP Min Withdrawal | - |

| MER | 2.63% |

|---|---|

| Management Fee | 2.25% |

| Load | Back Fee Only |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!